The continuous waves of COVID-19 have challenged the Vietnam industrial market in Q3 2021, and heavily impacted the Southern region. In July, Directive 16 was applied in HCMC, Binh Duong, and Dong Nai that nearly frozen the inter-province transportation of labour force and goods. From what was experienced in Bac Ninh, the government and manufacturers adjusted their plan frequently to maintain the production and safety of the labour force during this challenging period.

- Solutions such as “3 on the spot”, “1 route 2 destinations”, prioritize vaccine for workers in the industrial park, material truck drivers and shift work to reduce the number of workers at the same time helped maintain production.

- Despite difficulties in maintaining business continuously, landlords actively support tenants by extending the payment term, facilitating the document process for the tenant to get COVID-19 tests, and vaccinating. Landlords also consider case by case to support rent and management fee reduction.

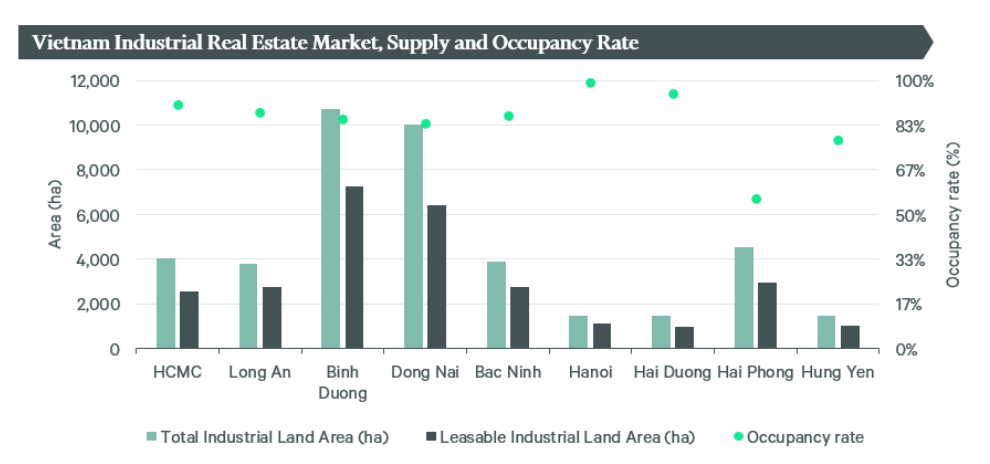

Average occupancy rates of existing industrial parks in five key Northern industrial cities and provinces (Hanoi, Bac Ninh, Hung Yen, Hai Duong, and Hai Phong) reached 78.5%, a 0.5 ppts increase y-o-y in Q3 2021. Similarly, the occupancy rate of four key Southern industrial cities and provinces reached 87.2%, a 0.2 ppts increase y-o-y. Regarding transactions recorded in 9M 2021, the sizes of land lease transactions are between 3ha to 25ha. The most common land size is between 3ha and 5ha, with demands from the furniture and electronics manufacturing, logistics, and packaging industries. In Q3 2021, demand for industrial land and warehouse/ready-built factory slightly declined because of the impact of COVID-19 on inter-provincial travelling and international flights. CBRE expects the market will become active again after restrictions are gradually lifted in Q4 2021. Thanks to the high occupancy rate, despite the impact of the pandemic, average industrial land asking rents remained stable in major industrial provinces.

The scarcity of assets in prime locations in Hanoi and HCMC has prompted many occupiers to search for places in satellite cities to enjoy proximity to large populations and relatively cheaper rent. The connections between HCMC and Hanoi to their nearby regions are gradually improved thanks to infrastructure projects under construction, such as Trung Luong – My Thuan, Dau Giay – Phan Thiet in the South; Van Don – Mong Cai expressway, Ninh Binh – Hai Phong in the North.

Note:

- Asking rent of industrial land does not include VAT and Management fee.

- Asking rent of industrial land is calculated for the remaining lease term of a project (which is usually from 30 to 45 years).

With drastic changes during the pandemic, Vietnam's industrial real estate market became an attractive opportunity for domestic and international investors. Besides, industrial park developers are quickly responding to occupiers' changing requirements. They have applied modern technology to the management and operation of the facility, provided service packages, including legal, human resources, to help customers save time and costs during project implementation. Virtual reality technology is also applied to introduce factory and industrial land to help customers experience products online, as a site visit is yet to be available.

Source: CBRE